SEE WHATS NEW

DISCOVER MORE LENDERS ON MORTGAGE AUTOMATOR

Mortgage Automator is one of Filogix’s mortgage marketplace partners connecting brokers to a multitude of private and MIC lenders in the industry.

Mortgage Automator is one of Filogix’s mortgage marketplace partners connecting brokers to a multitude of private and MIC lenders in the industry.

Check out their expanding list of available lenders at https://www.mortgageautomator.com/filogix/.

Launch of the First-Time Home Buyer Incentive (FTHBI) program

With the September 2, 2019 launch of the Federal Government’s First-Time Home Buyer Incentive (FTHBI) program, the Mortgage Insurers (CMHC, Genworth and Canada Guaranty) have been in extensive discussions with Canadian Mortgage Lenders in regards

With the September 2, 2019 launch of the Federal Government’s First-Time Home Buyer Incentive (FTHBI) program, the Mortgage Insurers (CMHC, Genworth and Canada Guaranty) have been in extensive discussions with Canadian Mortgage Lenders in regards to the manual procedures required for a Lender to request the program from the Insurer.

Similar to this manual request process between the Lender and the Mortgage Insurer, there will also be a manual request process between the Mortgage Broker and the Lender for this program. Based on our discussions with many Lenders, here is a general recommendation regarding how to reflect the FTHBI program request on your Filogix Expert mortgage application:

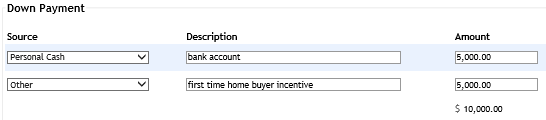

1. Break down the Down Payment Sources

Use the capability within Filogix Expert to break down the down payment sources to reflect the portion eligible under the program, with the ‘Description’ area being a free-format text entry field to indicate this. This down payment breakdown is currently included with the data sent to the Lender:

2. Use the “Lender Notes” Function

Use the Lender Notes function within Filogix Expert to request application of the incentive program to the mortgage request. The content in the Lender Notes section is currently sent to the Lender with the mortgage request data:

![]()

It is the responsibility of the Mortgage Broker to:

• Determine if their client is eligible for the incentive program;

• Apply that down payment amount to the total down payment for mortgage calculation purposes;

• Obtain signed consumer consent as per the FTHBI consent form; and

• Request the program (with explanation) as part of their mortgage submission to the Lender.

Information on the First-Time Home Buyer Incentive program including eligibility calculators and consumer consent form can be found on the following website:https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive

Thank you,

Filogix Broker Services

Join Filogix at MPC’s Mortgage Symposium Halifax on June 17!

Stay ahead of the game by attending MPC’s Halifax Mortgage Symposium to discover the latest mortgage information and insights designed to help tackle business challenges, reveal practical solutions and create new opportunities. Join Tim Rye,

Stay ahead of the game by attending MPC’s Halifax Mortgage Symposium to discover the latest mortgage information and insights designed to help tackle business challenges, reveal practical solutions and create new opportunities. Join Tim Rye, Head of Filogix, to learn more about how we are building tools and establishing new partnerships to offer mortgage professionals unrivaled choice and flexibility to run their businesses.

June 17th will also mark the official launch of Finmo in Atlantic Canada. Finmo, a member of the Filogix mortgage marketplace, enables mortgage brokers to easily offer their clients a digital mortgage experience and ultimately streamline their workflow. Finmo will be hosting a launch presentation on June 17th immediately following the end of the conference at 3:45pm in Room 501 at the Halifax Convention Centre. We invite you to attend to learn more about the Finmo (www.finmo.ca) offering.

To register or to learn more, click here.